[ad_1]

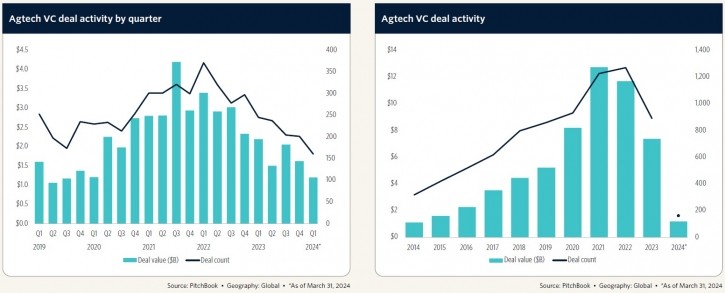

World enterprise capital investments within the agtech trade started 2024 with a “whimper not a bang”, in keeping with PitchBook’s Q1 2024 Agtech Report.

Deal counts have dropped to ranges not seen since earlier than 2018, in keeping with the funding intelligence agency’s knowledge.

This mirrors investments within the broader VC market, which fell to a close to five-year low within the first three months of 2024, in keeping with PitchBook (with the variety of estimated offers additionally falling to a close to four-year low), as excessive rates of interest weighed on funding for firms.

Why is agtech being dwarfed by general VC exercise?

Agtech offers have recurrently made up 2.1% to 2.4% of all VC offers by depend since 2018. Nevertheless, their values seem like declining quicker than general VC, in keeping with the information. In 2022, VC investments in agtech start-ups accounted for two.2% of complete VC. This determine dropped to 1.6% within the first quarter of this 12 months.

General funding in Q1 was a continuation of the downward development of funding exercise. In complete, agtech start-ups raised $1.2 billion throughout 161 offers, down 25.8% and 20.3% respectively in comparison with the identical knowledge within the earlier quarter.

Q1 noticed its weakest quarterly VC-backed exit exercise since 2019, with solely six exits, down from 11 in This fall 2023. Notable exits this quarter included the acquisition of indoor mushroom farming firm Smallhold by Monomyth Group and the acquisition of autonomous livestock monitoring know-how supplier CattleEye by GEA Group.

“A difficult fundraising surroundings could have eradicated a lot of the froth that elevated valuations to such heights over the previous 5 years,” the report said. Froth refers to an overheated and inflated VC market, characterised by extreme hypothesis, excessive valuations, and an abundance of capital chasing a restricted variety of offers.

Certainly, the median deal measurement was up 35% year-over-year, an indicator that extra offers are concentrated in “late-stage-boon firms”. Two firms, for instance, indoor strawberry grower Oishii and plant breeding platform Inari, each closed nine-figure rounds within the first of this 12 months.

The previous deal – $144.0 million Collection B loved by Oishii – was the most important in Q1 and stands in distinction to the indoor farming section, which has seen funding decline by an element of 5 from its peak in 2021.

However a slew of start-ups are forward of the curve

And regardless of declining deal counts, a number of classes registered an uptick in funding exercise. PitchBook logged 9 biomaterial offers within the quarter, up 28.6%, whereas plant biotech offers depend totalled 28, up 21.7% quarter-on-quarter.

The agribusiness marketplaces class noticed 25 offers, up 8.7%, whereas aquaculture startups closed 11 offers, up 37.5% quarter-on-quarter. “Agribusiness marketplaces are taking off as an innovation designed to streamline provide chains. The report “spotlights a slew of startups which might be forward of the curve,” it wrote, “from grain market supplier Indigo to seafood e-commerce platform Captain Contemporary.”

Agribusiness marketplaces current important alternatives for innovation and progress, famous PitchBook within the report. Blockchain know-how provides “a promising answer to reinforce traceability and transparency all through the provision chain, addressing issues associated to meals security and authenticity,” it mentioned.

Forging strategic partnerships and collaborations with authorities companies, non-governmental organizations, and monetary establishments can “amplify agribusiness marketplaces’ influence and handle systemic challenges extra successfully,” it added, to develop “complete options to sort out points akin to infrastructure improvement, entry to finance, and capability constructing”.

Key highlights from Q1

Agtech startups raised a complete of $1.2 billion throughout 161 offers in Q1 2024, a decline of 25.8% and 20.3% in deal counts and funding, respectively.

The most important deal in Q1 was a $144.0 million Collection B funding in Oishii, a vertical farm operator specialising in premium strawberries.

Different notable offers embody Inari’s $103.0 million Collection F, Deputy’s $37.0 million late-stage VC spherical, and Loyal’s $76.3 million Collection B.

Valuations within the agtech sector underwent a correction, with the median pre-money valuation lowering by 8.6% from 2023. Nevertheless, the median deal measurement elevated by 35.5% year-on-year to achieve a report excessive of $4.3 million.

Q1 2024 witnessed the weakest quarterly VC-backed exit exercise since 2019, with solely six exits recorded.

The highest venture-growth VC-backed agtech firms by complete VC raised thus far are:

- Indigo: Raised $1,951.6 million, with a excessive IPO chance of 96%.

- Farmers Enterprise Community: Raised $1,074.2 million, with a excessive M&A chance of 23%.

- Loads: Raised $941.0 million, with a excessive IPO chance of 69%.

- Apeel Sciences: Raised $665.0 million, with a excessive IPO chance of 92%.

- Ynsect: Raised $583.4 million, with a excessive IPO chance of 66%.

The highest VC buyers in agtech firms since 2023 are:

- SOSV: Accomplished 13 offers, with a deal with early-stage and late-stage VC investments.

- S2G Ventures: Accomplished 12 offers, with a deal with late-stage VC investments.

- European Innovation Council Fund: Accomplished 12 offers, with a deal with late-stage VC investments.

Learn extra: Time to simply neglect the glory days of 2021?

As well as, it mentioned that “selling and incentivising sustainable farming practices in agribusiness marketplaces not solely enhances environmental stewardship but in addition fosters differentiation and worth creation, catering to the rising client demand for sustainably produced meals. By means of concerted efforts and revolutionary approaches, agribusiness marketplaces can overcome challenges and unlock their full potential as drivers of constructive change within the agricultural sector”.

The report additionally notes pleasure within the regenerative ag house. “Regenerative agriculture is gaining traction as a pathway to mitigate the environmental influence and carbon footprint of agriculture whereas additionally enhancing long-term farm well being and productiveness,” it mentioned.

By the use of instance, Mad Capital introduced a $50.0 million non-public credit score fund to assist farmers transition to regenerative practices.

HeavyFinance closed a €50.0 million fund to help agtech startups targeted on decarbonization and to assist farmers transition to regenerative practices.

EIT Meals and a coalition of meals organizations additionally introduced the Regenerative Innovation Portfolio: €30.0 million in funding to foster agrifood worth chain partnerships and scale profitable regenerative initiatives.

New agtech funds additionally embody Cibus Capital, which closed two agrifood funds: a $510.0 million middle-market PE fund and a $135.0 million VC fund; Seviora Capital, an funding supervisor anchored by Temasek and Norinchukin, which introduced a $173.0 million agrifood tech fund concentrating on Asia-Pacific firms; Acre Enterprise Companions, which closed a $140.0 million agrifood tech fund to put money into pre-seed to Collection B startups; and Hatch Blue, which closed a €75.0 million fund to put money into European aquaculture firms.

Different rising tendencies and occasions

One other rising tendencies highlighted by PitchBook is the persevering with menace posed to livestock and human well being by zoonotic ailments. A latest outbreak of fowl flu in dairy cows has unfold to at the very least 13 herds throughout six US states and has contaminated at the very least one individual. This similar flu has killed tens of tens of millions of birds, together with pre-emptive culling by poultry farmers. “Animal biotech and animal ag applied sciences will seemingly play an vital function in addressing this and future zoonotic outbreaks,” the report declared.

It additionally sounded the warning that European efforts to enhance farm sustainability see main pushback from farmers. The European Union has been taking steps to make farming extra environmentally pleasant, requiring farmers to chop the usage of chemical pesticides and fertilisers, in some circumstances lowering subsidies if extra sustainable practices should not adopted. Farmers say the measures are economically unsustainable and are demonstrating throughout Europe, blocking highways and metropolis streets, crashing political occasions, and, in some circumstances, sabotaging infrastructure.

“It’s unclear if the EU has a plan to deal with the financial challenges of transitioning farms to extra sustainable practices,” mentioned the report.

[ad_2]